© 2024 Gobi Partners

On the heels of Gobi’s second sustainability report being launched, it’s become clear that venture capitalist (VC) firms need to gradually abandon the currently prevalent, linear “take, make, dispose” model, and instead, look to invest in and enhance the circular economy ecosystem. This is crucial not just for the environment, but also for VCs and, by extension, the global economy as a whole.

I’ve mentioned before that by recognising the development of innovative, sustainable business models, VCs can pioneer this charge.

Thankfully, it’s a call to action that Gobi has taken seriously through the application of ESG frameworks from a foundational level, and this is rightfully reflected so in our report.

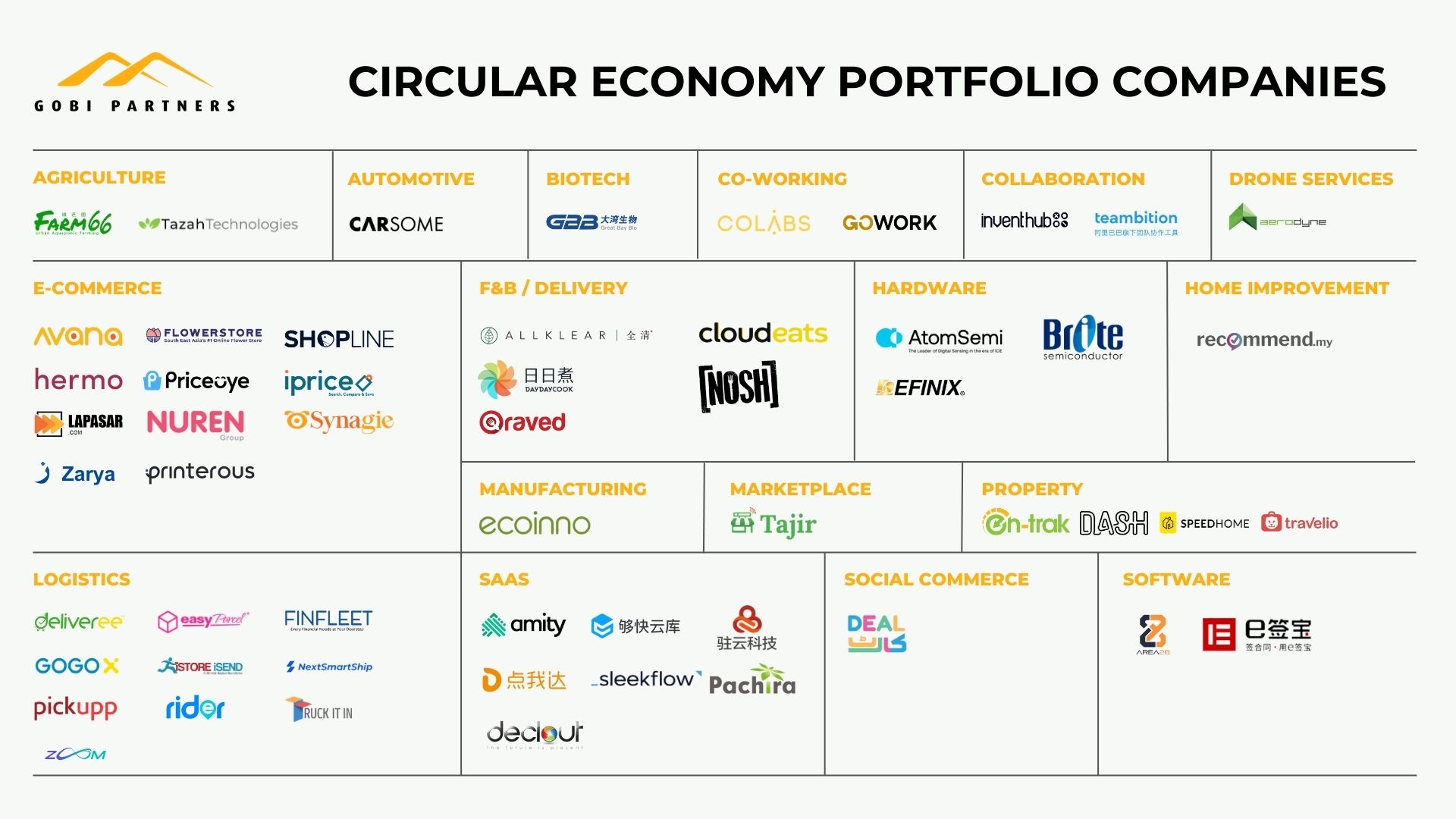

To ensure this is met at every stage of our operations, we start from the beginning; during the pre-screening process, taking into account the potential investment’s objectives, supply chain, location, and scale. As a result, we identified 62 companies across 22 industries with at least one of the CE principles; implementing circular models, designing out waste and pollution, keeping products and materials in use, and regenerating natural models.

However, as with all processes, there is still room for further improvement, especially within the companies’ consideration of their environmental impact. The low adoption of carbon reporting processes, and a notable absence of designated persons responsible for sustainability-centric practices, also might be pointing towards a lack of resources or knowledge.

As entrepreneurs increasingly recognise the significance of ESG principles in building sustainable ventures, Gobi aims to provide comprehensive guiding principles designed to support the journey of every portfolio firm and other budding ventures toward ESG compliance in their full capacity.

These include training and programs for startups to recognise how crucial investing in, and creating more, opportunities within the circular economy. Additionally, establishing a repository of tools and policy templates will be useful for portfolio companies that have yet to adopt them – such as green procurement and environmental policies, on top of clearer protocols related to risk, security, and sustainability.

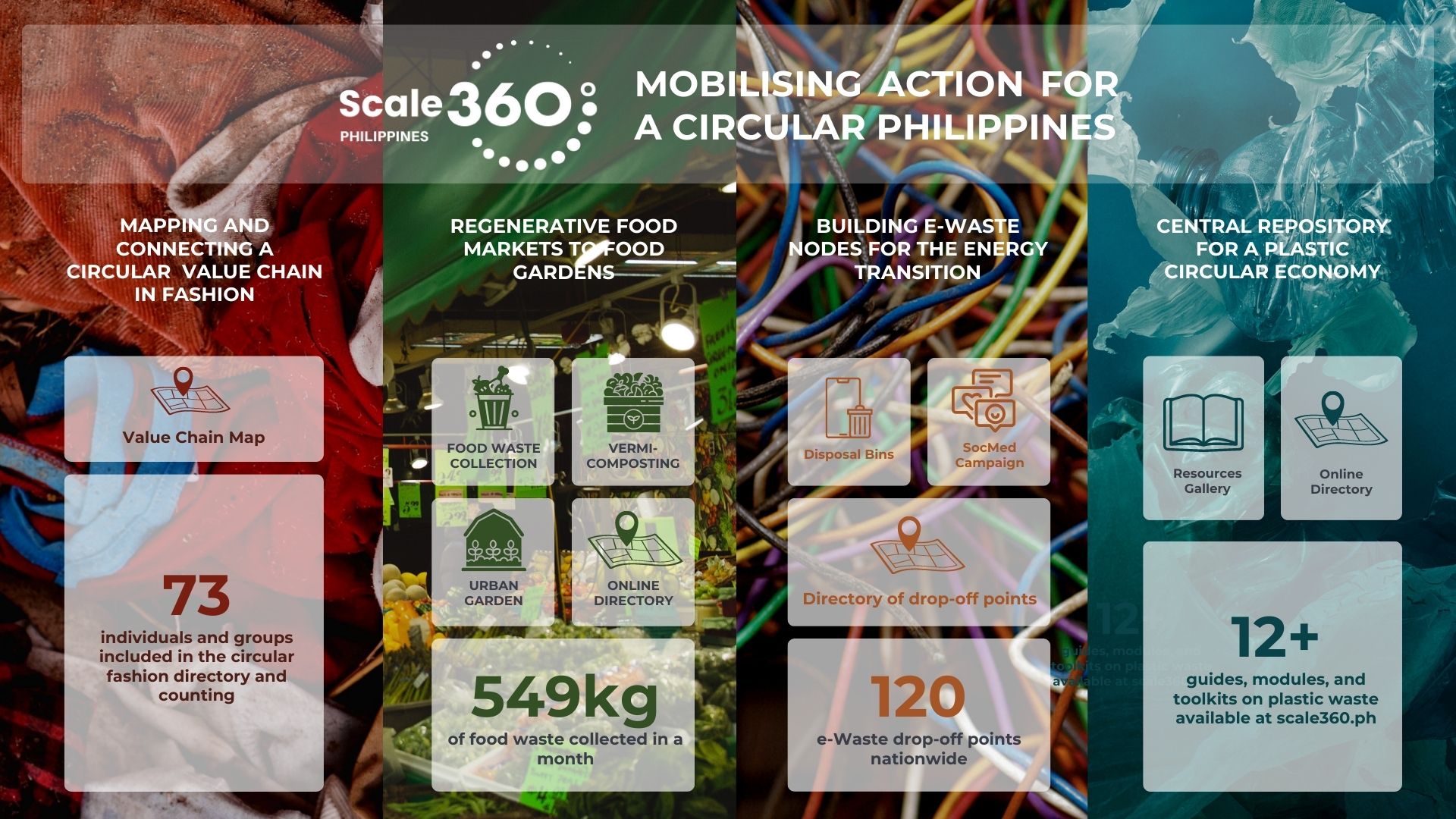

In line with these strategies, utilising my skills and experience as a founding member of Scale 360º – a Philippines-based organization partnered with Gobi. This is particularly key through its Scale 360 programme, which is designed to mobilise action across private and public sectors to grow the circular Fourth Industrial Revolution (4IR) ecosystem.

Aiming to establish a closed-loop, sustainable consumer economy through collaborative circular innovation, the programme also provides similar resources and toolkits to governments, founders, companies, and more, to reduce negative environmental impact, with a key focus on four key industries: plastic, fashion, food waste, and electronic waste.

Inevitably, these changes will take time, but watching our methods bear fruit has instilled new hope for a better, more viable future within the investment space.

As we move towards a more innovative, more sustainable future, we look to leverage the momentum we’ve gained in the past year to push for further progress for the betterment of companies, the economy, and the world.

Gobi Partners recently released their 2022 Sustainability Report, showcasing their steadfast commitment to advancing Environmental, Social, and Governance (ESG) practices and their unwavering dedication to adhering to the corporate sustainability principles outlined by the United Nations Global Compact. The report presents comprehensive insights and findings, offering a holistic view of Gobi Partners’ sustainable initiatives and their impact. To access the full report and its findings, kindly click the button below.