© 2024 Gobi Partners

Financial literacy is becoming increasingly important, especially in the digital age, so it is essential to teach children good financial habits from a young age. Enter Vircle, Malaysia’s first family finance app with a mission to help parents raise money-smart kids in an increasingly digital world. Serving as a vanguard, Vircle is leading the way in transforming the financial understanding of both children and parents. As a catalyst for change, Vircle aims to address the challenges faced by the younger generation in understanding the value of money.

Founded by Gokula Krishnan Subramaniam, a father of two, Vircle draws inspiration from witnessing his children growing up with a limited understanding of the value of money. Driven by this observation, he set out to instil a sense of financial responsibility in children. His vision is to guide children towards financial independence by learning to Earn, Spend and Save responsibly through Vircle.

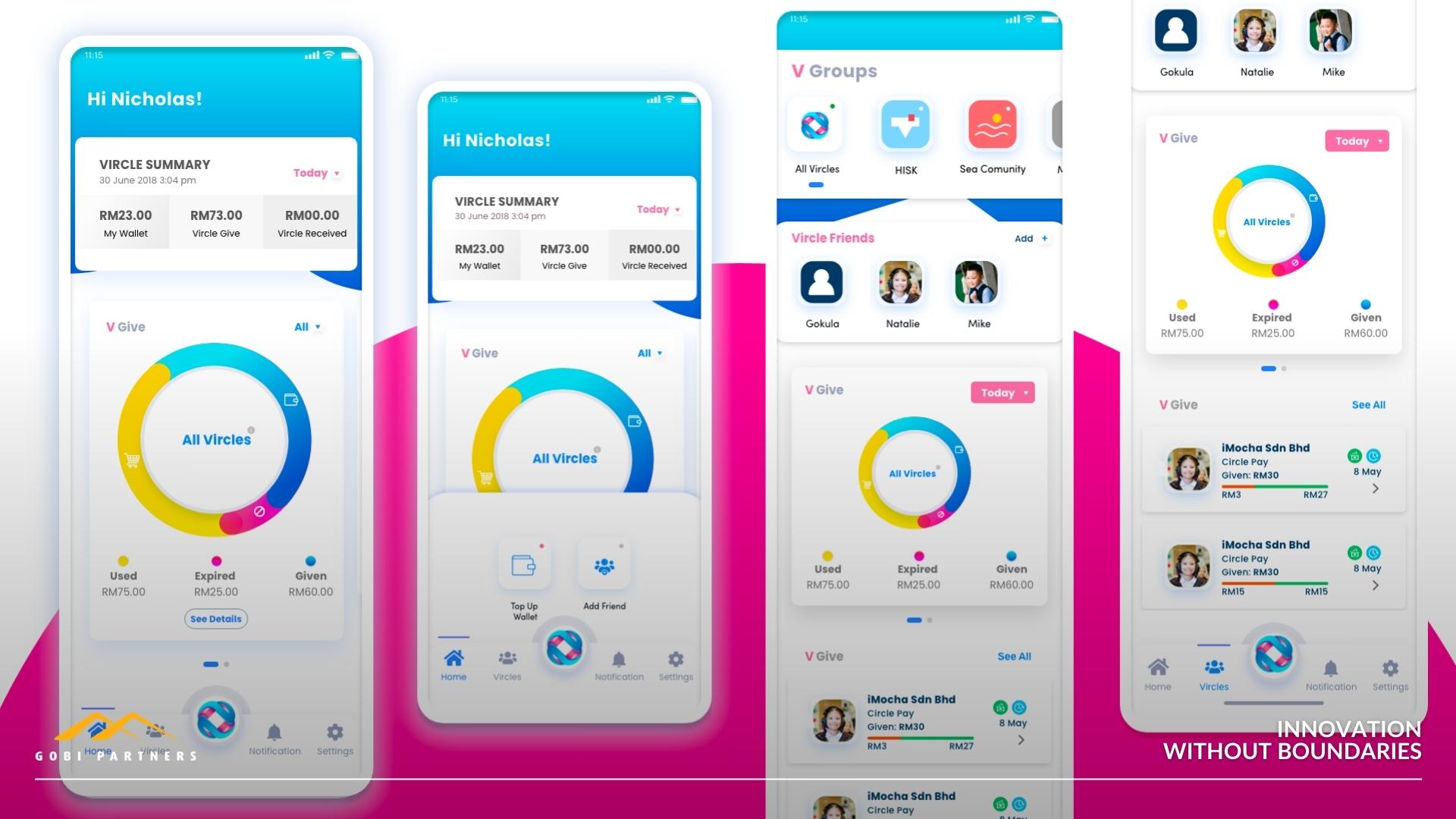

The name “Vircle,” a clever amalgamation of “Visible Circle,” reflects the platform’s commitment to building a circle of trust between parents and children in matters of financial well-being and education. This unique approach positions Vircle as Malaysia’s first family finance and neo-banking app, setting it apart from traditional financial platforms.

Vircle’s unique features, such as a shared family balance and a proprietary Parental Control engine, make it the go-to platform for families seeking financial management solutions. With a singular family account overseeing all dependants, Vircle simplifies the process of instilling money-smart habits in children.

The introduction of the Child Safe Visa card, equipped with spending controls and parental oversight, represents a significant step towards making online transactions safer for children. As Vircle expands its services to public schools, the platform aims to bridge the gap in financial education across diverse socio-economic backgrounds.

Vircle’s rapid scalability, proven by its presence in over 58 educational institutions, is a testament to its efficiency. In alignment with its mission, Khazanah-backed Gobi Dana Impak Ventures (GDIV) has supported Vircle, aspiring to bring financial literacy to all layers of society.

“We have an ambitious goal of banking one million Malaysian children and three million across Southeast Asia in the next five years underpinned by focused execution and product-led growth. With GDIV’s support, we’re aiming to embed deep with parents to constantly innovate based on their needs, Vircle aims not only to meet but exceed these targets and together with GDIV our vision is getting closer,” expressed Gokula.

Vircle’s collaboration with like-minded institutions and parents is pivotal in its mission. This ensures inclusivity in a segment often neglected by mainstream players, while collaboration with parents allows for real-world insights that shape the platform’s development.

Vircle’s commitment to instilling financial literacy from a young age and its unique approach to family finance position it as a pioneer in the industry. As it strives to empower millions of children across Southeast Asia, Vircle’s vision aligns seamlessly with the GDIV mandate, making it a promising force for positive change in the financial landscape.

This has been part of the #GobiDanaImpakVentures: Empowering Malaysia series.